How to Find Investment Properties in a Competitive Market:

How to Find Investment Properties in a Competitive Market:

Data and Tech Combine to Make Finding Investment Properties Easier, Better, Faster

In the current market, it’s DEAL FLOW that separates the successful investors from the rest. Finding investment properties with profit potential is the foundation of any successful investor’s business. Landlords looking for cash flow, flippers looking for great margins and wholesalers who need to quick turn contracts all need consistent sources of viable, profitable investment properties.

What Doesn’t Work for Finding Investment Properties

Using the MLS to Find Investment Properties

It doesn’t take long to figure out that the local MLS is NOT the place to find great deals on investment properties. At its core, the MLS is collection of data. But it’s not the right data that real estate investors need to find properties at bargain prices.

Find Discounted Houses (Not Listed On The MLS or Zillow)

Mailing Lists for Real Estate Investors

Then there are LISTS. In the past, investors have spent a FORTUNE on buying lists of homeowners – with the HOPE that someone on the list might be motivated to sell their house. Some of the common categories are absentee/out of town owners, owners of vacant and estate/probate properties or lists of owners who are delinquent on their house payments. But the problem with lists is twofold. They offer limited information. And even worse, they are outdated pretty much the minute they’re generated. The status of properties changes daily – but the lists do not. List buying is the ultimate in “shotgun marketing” – find a big target and hope something hits.

So How Do You Find the Data you Need to Source Investment Properties?

Going to the court house, driving for dollars, and hiring bird dogs are also ways to get information on potential off-market investment properties. These approaches are more targeted and work better than the shotgun approach, but the problem is the amount of time and effort it takes. In the real world of real estate investing, simplified off-market deal finding lets the investor focus on creating profits rather than constantly chasing dead-end leads.

Real estate investors as a whole have an entirely different subset of needs in the real estate technology space. Finally, the combination of advancing technologies and big data has handed local real estate investors access to two major components of every real estate deal: properties and funding. Ross Hamilton, Forbes

Solving the MLS Investment Property Problem – Sourcing OFF MARKET Properties

With more than 2 million properties listed for sale at any given time, novice real estate investors and retail home buyers often turn to the MLS to find properties. But real estate investors can’t thrive where they’re competing against retail home buyers willing to pay top dollar.

Savvy real estate investors and even the big hedge funds can go off-market and manually search through over 137 million unlisted properties to find a profitable investment. But this painstaking process is expensive, difficult, requires access to proprietary data sources and it takes forever.

Fortunately, the process for finding exceptional investment property opportunities has taken a dramatic turn for the better. With demand comes innovation and now anyone looking for income-producing properties has access to the same “big data” as the big Wall Street firms. And even more importantly, this data been simplified and made usable to the real world investor.

It’s one thing to have data. It’s quite another to be able to make sense of it, leverage it in order to gain a competitive advantage – and take action to acquire your next big deal on an investment property.

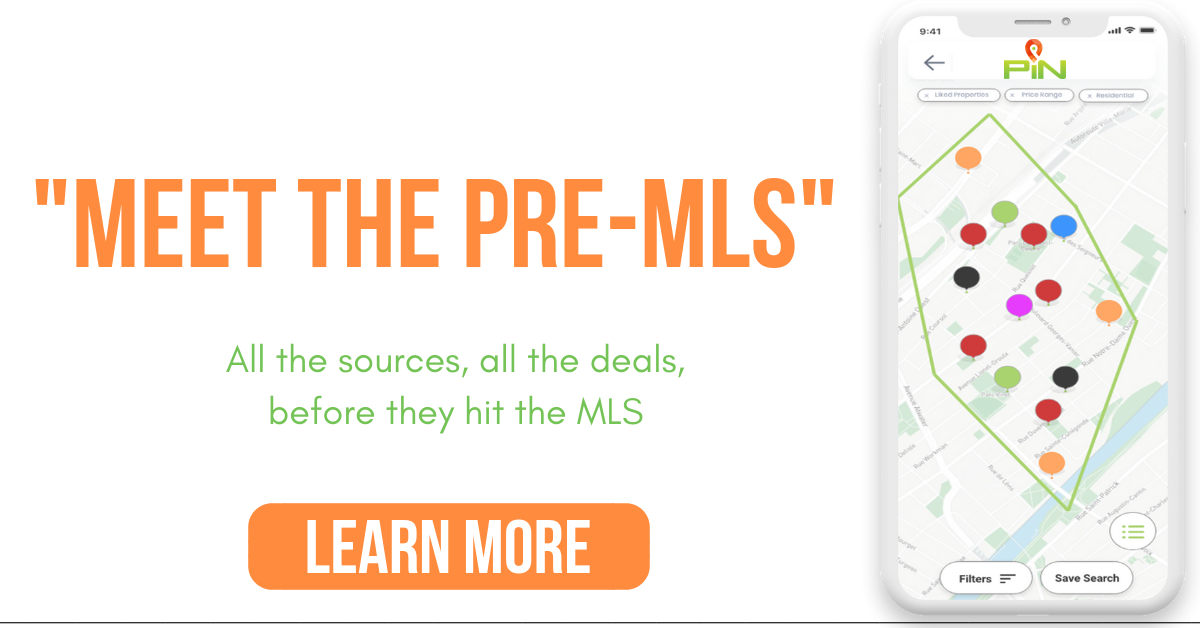

PiN analyzes billions of data points, pulled from a variety of data sources, on every property across the US. The data is then synthesized, analyzed, graded, and organized to “pinpoint” off-market houses that can be bought for a fraction of retail price. Real estate wholesalers, landlords, hedge funds and fix & flip investors can find properties to buy, rent or quick flip that are NOT available to the general public.

Where does the Off-Market Property Data Come From?

There are literally hundreds of data providers and aggregators that capture data on everything imaginable from property data to information on any of us. We are bombarded in the news of security breaches, and privacy issues involving large retailers, banks, and enterprises like Facebook and Google. In fact, around 75% of the most popular websites use tracking tools, equating to more than 3,000 data points on each one of us. Make no mistake – there is more data than anyone can truly consume.

Real World Real Estate Investment Property Data

The challenge in the world of real estate investing is harnessing all of this data, and focusing only on the data relevant to a specific purpose. This is the foundational element of PiN. PiN is purpose-built by real estate investors – for real estate investors. This seemingly simple starting point, translates into a laser-focused tool that allows PiN to translate billions of data points into a reliable source of off-market property information.

With a very clear focus on the data real estate investors need most, PiN encapsulates information on properties with owners that have mitigating circumstances that can motivate them to sell. Some of the more obvious data comes from the USPS and County Recorder’s offices. Many other sources required modification or repurposing to meet the needs of investors

- Pending Foreclosure

- Vacant Properties

- Absentee Ownership

- Probate and Estate Properties

- Shadow and Zombie Properties

- Courthouse Auctions

- FSBO

- Expired Listings

Real Estate Data By ZIP CODE

Many real estate investors only work specific markets rather than investing nationwide. ‘PiN Local’ provides data from only the zip codes you are most interested in. For more info, contact our Customer Success Team at 888-204-7501 Ext 177

What You’ll Discover Inside PiN

What makes PiN so innovative in today’s real estate investing climate is the wealth of information and even better… the information is constantly updated. This gives investors unprecedented access to quality off-market property data that can be used to regularly locate properties to generate income.

All of this allows real estate investors to quickly and easily find, filter, sort and save properties that meet their investment criteria in any market nationwide. That combined with the wealth of information on each property gives PiN users a huge advantage that can accelerate property acquisitions.

Big Data for Real Estate Investors: Property Information Inside PiN

Depending on the data source, the location and the property, PiN users find key information such as:

- Property Owner’s Information including last known address, phone, email

- Property Info including location, value, debt, equity, purchase date and price

Seller Contact Information

We recognize that getting any available contact information for these motivated sellers is quite valuable. For that reason, we work to provide as much information as we can find. Beyond the property address, whenever possible we include mailing address, email, phone, and even social identities. Keep in mind, there are specific life circumstances that often make contact details extremely difficult to accurately identify. As you can imagine, motivating circumstances like pre-foreclosure, probate or more often puts the contact details for the owner is in flux to say the least.

Ross Hamilton, Attom Data Solutions Housing News Report

Motivated Seller Data

In addition, all properties are identified as falling into any of the following statuses and filters that can indicate seller motivation.

Pre-foreclosure Data

Once a homeowner has missed enough mortgage payments for the lender to initiate the foreclosure process, the property record is added to PiN listed as Pre-foreclosure. We collect this data through analyzing public records filed at every courthouse. We look for Lis Pendens or Notice of Default. These are the documents that lenders must file to start the foreclosure process. Note that each county has different technology and reporting requirements, so timeliness can vary greatly depending on the county, holidays and the county clerk who is adding the data. Pre-foreclosure properties undergo many changes in status as the move through the process from default to full foreclosure. Each day, pre-foreclosure files are reviewed for updates to the file. Unless the homeowner and lender agree to a workout program, the data moves the property from Pre-foreclosure to Auction, whenever an auction date is set for the property to be sold on the courthouse steps. As the Notice of Foreclosure Sale or Notice of Trustee Sale documents are generated, the PiN program updates the foreclosure status from Pre-foreclosure to Courthouse Auction.

This lets you know the homeowner’s motivation to solve their problem is increasing and you need to plan on going to the court house to bid. Because these auction dates may be adjusted or delayed, often without a new document created, Connected Investors will continue to display these properties as Courthouse Auction for an additional 60 days past the auction date. Once the courthouse auction date has passed, we constantly check the record to see if the ownership status has changed. There are 3 possible scenarios. First, if the property is sold at the courthouse auction, a new owner with a sale document is created, and the record is removed from PiN. Secondly, if the property does not sell at auction, the bank takes possession of the property and is listed as shadow inventory.

Shadow Inventory Data

Shadow Inventory is a bank-owned property not yet available for sale to the general public. Each day we check to see if the property has been listed on the MLS. The property will remain in shadow status until the property is sold or listed. If the property is listed for sale, the status will change from shadow inventory to Bank Owned and will stay in this status until it is sold. It’s worth noting that Shadow Inventory and bank-owned properties are almost always vacant.

Previous Hardship Data

If the property does not change hands after the auction date, it typically means the owner has made up their back payments or the bank has done a loan modification. Banks are not required to file any paperwork if the homeowner reinstates the loan or enters into a workout program, though many banks file a recording document (Notice of Rescission, Order of Dismissal, Release of Lis Pendens). This lets us and everyone know the property is no longer in pre-foreclosure. When we see this documents recorded, we move the property from pre-foreclosure into Previous Hardship.

Aged Lead Data

Just because the homeowner made up their back payments does not mean their financial problem has been solved. In some cases, an aged lead can still be a viable lead. If there is no status update for 180 days, the property becomes an Aged Lead. This simply means we cannot determine what is happening with this file at this time. This is another area where state reporting requirements vary widely, some may not require an update for more than 1000 days. If any updates are found to aged leads we update the status accordingly. These status changes serve as a ‘tap on the shoulder’ to let you know to keep your eyes open.

Vacant Property Data

Not all vacant houses are worth the attention of real estate investors. Reaching out to the owners of vacant second homes, rentals or vacation homes is a waste of time. When a real estate investor is looking for vacant homes to buy at a discount, they are looking for a property owned by an individual (not a bank or a company) that is motivated to sell. To bring you what you need, PiN cross references vacant house data with other third-party data sources such as tax assessor data, post office data and more. This weeds out the non-motivated sellers from the motivated sellers. We initiate this process every day to ensure the property is still vacant. If a property sells or is no longer vacant, the property is then recategorized as an Aged Lead.

Note: It is possible for a property to be listed as both Vacant AND Owner Occupied. How does this happen? Vacant indicates that no one resides in the property, but Owner Occupied is driven by the county tax offices indicating that the property tax bill is still mailed to the physical residence – even though it is unoccupied. In these cases it may help to use a skip trace service as the best route to reach the owner. When the property is Non-Owner Occupied AND Vacant, you simply target the mailing address to reach the owner.

Probate Property Data

When a homeowner passes away, the surviving loved ones or family members can be highly motivated to sell. PiN cross references multiple data sources to identify these properties, and the heirs. It’s worth noting that in addition to being Probate leads, these properties may also be Vacant, Pre-foreclosure, FSBO, Zombie or other status. As you can imagine, the loss of a loved one is a very emotional time for those left behind. Accordingly, while we want to avail PiN users to motivated sellers, and we also want to be sensitive to individual situations and expect you to be, too. For that reason, the majority of Probate leads inside PiN are also Vacant properties. Not only does that ensure a level of courtesy, but as an investor, a Probate + Vacant lead are among the most valuable.

Expired Listings Data

When a property was listed for sale but ownership status has not changed, it is included in local Expired Listing data. In some cases, expired listings can be a source of good leads for both investors and real estate agents.

Online Auction Data

Searching across multiple real estate auction sites like Auction.com, Xome and Hubzu is a time consuming waste of effort. Property that shows up for sale on these sites is infused with our in-house data to give you comprehensive data on the property that allows you to find, filter, manage and monitor upcoming auctions in the areas of your choice.

Motivated FSBO Data

This includes property that is listed for sale by owners on FSBO.com that has signs of a motivated seller. This information is combined with our in-house data to give you comprehensive data on the property that allows you to find, filter, manage and monitor FSBO properties in your target investment areas. 10

Craigslist Data

This filter includes properties listed on Craigslist that shows signs of a motivated seller. Craigslist information is combined with our in-house data to give you comprehensive data on the property that allows you to find, filter, and manage active Craigslist posts of interest.

The Future of Big Data for Real Estate Investors

In the not too distant future, AI will make real estate data easily accessible by voice command. “Find me vacant probate properties in Scottsdale, Arizona” will soon be a reality – making the time consuming, old-school methods for locating properties 100% obsolete. Expect this and more as data, AI and user needs drive innovations in data sourcing and use.

Tech and Big Data Makes Finding Off-Market Properties Effective and Efficient

Clearly, combining the technology, data and the needs of the real estate investor has made finding properties and maintaining deal flow simpler than ever. Gaining access to a wealth of information about motivated sellers and discounted properties has been the holy grail for real estate investors for years. It’s now possible for any kind of property locator to identify and connect with potential sellers in all sorts motivating circumstances. It’s a win-win scenario that can put motivated sellers in a position to solve a property problem through the services of wholesalers and real estate investors in nearly any market.

FREE Real Estate Investing Resources

Direct access to Private Lenders

Real Estate Investing Apps For Android

Real Estate Investing Apps For Apple

The post 2021 Trends: How To Find Off-Market Properties appeared first on Connected Investors Blog.

wholesale real estate denver, wholesale properties for sale, denver wholesale real estate deals, wholesale homes in denver, real estate wholesale colorado, off market real estate CO, denver real estate investing, wholesale property, wholesale deals, discount real estate, wholesale homes for sale, wholesale houses for sale, wholesale real estate companies denver, denver wholesale deals